Benchmarking: The Art of the Science

Craig L. Israelsen, Published in the AAII Journal in November 2019 (Updated in January 2020 with full-year 2019 performance)

As found in the Merriam Webster dictionary the term “benchmark” has the following definitions:

- a mark on a permanent object indicating elevation and serving a reference in topographic surveys and tidal observations.

- a point of reference from which measurements may be made.

These definitions clearly suggest that a benchmark serves as a point of reference. The real key here—in the world of investments—is selecting a performance benchmark that is similar to the portfolio being measured against it. This often does not happen, which is why performance benchmarking so often is sheer lunacy.

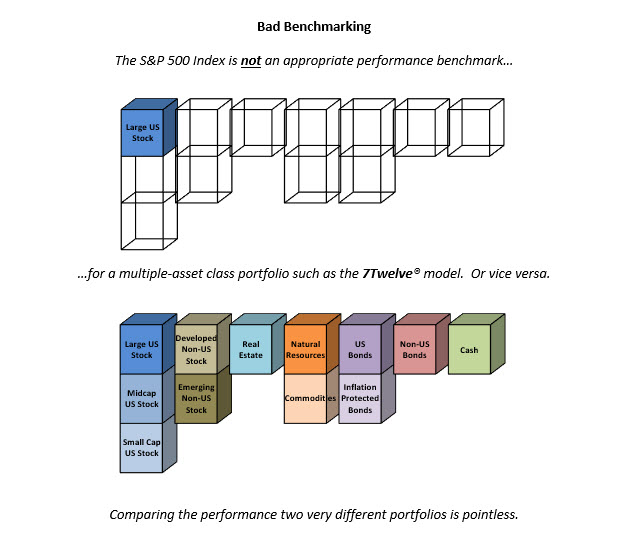

For example, the performance of a diversified portfolio that contains stocks, bonds, and diversifying asset classes (real estate, commodities, etc.) is often compared against the S&P 500 Index—an index that only contains large cap US stocks. At first blush, this may seem reasonable inasmuch as the S&P 500 index is a well-known index. Here’s the problem: The S&P 500 Index is not similar to a broadly diversified, multi-asset portfolio. Using the S&P 500 Index as the de facto performance benchmark for a wide variety of investment portfolios standard is analogous to comparing the taste of salsa to one of its ingredients, say tomatoes. Salsa contains tomatoes, but it also contains a variety of ingredients that make it—collectively—quite different than any of its individual ingredients.

Consider the following conversation:

“How do you like the salsa?”

“Oh, it’s great…but when I compare it against sliced tomatoes it tastes quite different.”

“Really? You’re kidding, right? Of course it tastes different than raw tomatoes. Why are you comparing salsa against tomatoes?”

“Well, I figured that since salsa contains tomatoes that would be a reasonable comparison.”

“Yikes! That’s crazy. Salsa should only be compared against another type of salsa.”

How does this relate to the performance comparison of different types of portfolios?

“How do you like the diversified, multi-asset portfolio?”

“Oh, it’s great…but when I compare it against the S&P 500 Index it performs quite differently.

“Really? You’re kidding, right? Of course it performs differently. Why are you comparing a diversified portfolio against one of its ingredients?”

“Well, I figured that since the portfolio contains large cap US stocks that would be a reasonable comparison.”

“Yikes! That’s crazy. A diversified portfolio should only be compared against another type of diversified portfolio.”

As shown in “Bad Benchmarking”, comparing a multi-asset portfolio against only one of its ingredients is not helpful, valid, or even logical. The primary reason it’s often done is because of habit and because it’s easy to track the performance of an index that is publicized as broadly as the S&P 500 Index. However, habit and ease are seldom the hallmarks of “best practice”.

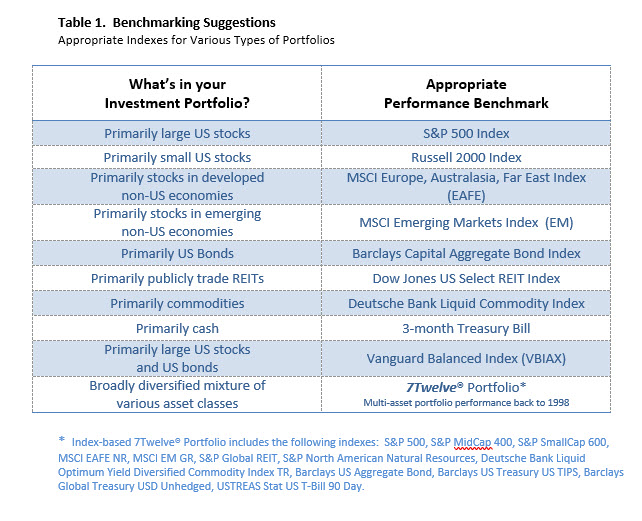

So, what is the correct “point of reference” that could serve as an appropriate performance benchmark for various investment portfolios? There is not just one—there are many.

Permit me to propose appropriate benchmarks for various investment portfolios (see “Benchmarking Suggestions”). If your portfolio is comprised primarily of large cap US stocks (say, over 80% of your portfolio) then the S&P 500 Index is an appropriate benchmark. Conversely, if your portfolio is primarily a mixture of US stocks and US bonds a likely benchmark would be Vanguard Balanced Index (VBIAX).

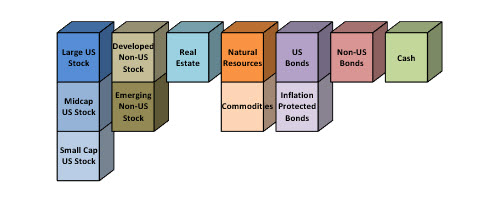

However, if your portfolio is comprised of a broad selection of asset classes, including US stocks, non-US stocks, real estate, resources and commodities, US bonds, non-US bonds, and cash an appropriate performance benchmark is the 7Twelve® Portfolio.

A multi-asset portfolio (think salsa here) should be compared against a multi-asset index. Enter the 7Twelve® Portfolio, a portfolio model that incorporates 12 different asset classes in equal portions. The 12 asset classes are large cap US stock, mid cap US stock, small cap US stock, non-US developed stock, emerging stock, real estate, natural resources, commodities, US bonds, TIPs, non-US bonds, and cash. (Full disclosure: I am the developer of the 7Twelve® Portfolio).

Of Indexes and Investors

There can be a serious disconnect between investors and the indexes they reference—which can lead to a great deal of benchmarking confusion. Actual investors have been (or should be) building diversified, multi-asset portfolios. The problem is a lack of multi-asset, broadly diversified indexes to serve as appropriate performance benchmarks. Enter the 7Twelve® Portfolio which now serves as an appropriate benchmark for a broadly diversified portfolio. The performance of the 7Twelve® Index (which is patterned after the 7Twelve® Portfolio) is calculated by S&P Dow Jones Custom Indices and is available at: http://www.customindices.spindices.com/indices/custom-indices/lunt-capital-7twelve-moderate-index

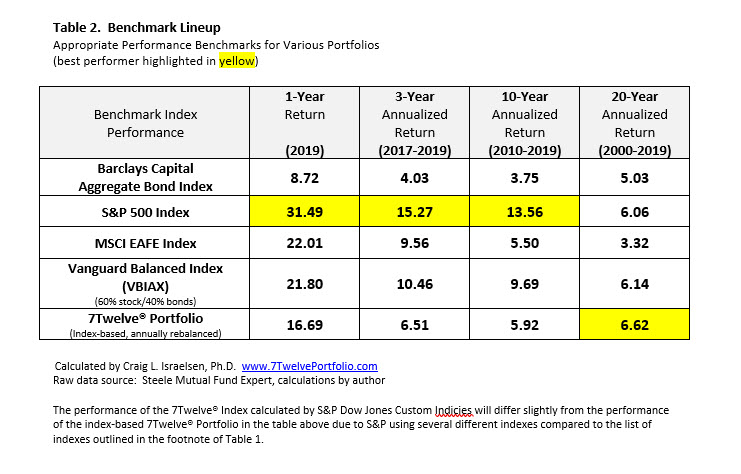

The annualized performance of several key benchmark indexes are shown in “Benchmark Lineup”. As can be seen, the performance difference between “benchmarks” can be large—hence the importance of using the most appropriate one.

Consider the performance differential between US bonds (Barclays Capital Aggregate Bond Index) and US large cap stock (S&P 500). For the three-year period of 2017-2019, the performance difference was sizable: 4.03% for bonds vs. 15.27% for stocks. However, over the past 20 years from January 2000 through December 2019, US bonds actually came close to the performance of the S&P 500 (5.03% vs. 6.06%). The main point is simply this: bonds should not be used to benchmark stock, or vice versa.

As you can see, the S&P 500 Index will often outperform a broadly diversified portfolio (the best performing indexes are highlighted in yellow). The 3-year and 10-year returns of the S&P 500 Index are considerably higher than the 7Twelve Portfolio, for example. However, over the past 20 years we see the value of broad diversification. The index-based 7Twelve Portfolio produced an average annualized return of 6.62% vs. a 6.06% return for the S&P 500. However, those two are not the same thing—so they should not even be compared….remember! Practically speaking, it’s fine to look at the performance of the S&P 500 Index. It just shouldn’t be used as a performance benchmark for a portfolio that is broadly diversified across multiple equity and fixed income asset classes.

All of this reminds us why the performance of the S&P 500 Index (or any other index that only measures the performance of only one asset class) is an inappropriate performance benchmark for a portfolio that includes a variety of asset classes.

Craig L. Israelsen: Published in the AAII Journal in November 2019 (Updated in January 2020 with full-year 2019 performance)