Portfolio Rebalancing 2020 Year End Tips – Beat The Rush

As we’re nearing the end of 2020, we pass along this reminder that now might be an ideal time to review your portfolio and identify if any rebalancing changes may be necessary to reach long-term goals. Here’s a multi-step guideline that you will find helpful to accomplish this important portfolio management task.

Step 1: Setting your portfolio allocation targets:

- select the portfolios menu

- for a listed portfolio, select the portfolio allocations tab

Given your goals for growth w/ investment risk, enter a portfolio asset mix for cash v. fixed income v. U.S. stock. For example, if your goals are for moderate growth, willing to accept a mix of investments offering less risk (and reward) than a pure equity portfolio, a possible portfolio asset mix might be:

- Cash: 10%

- Bonds: 25%

- U.S. Stock: 65%

- Further breakdown:

- U.S. Large Cap Stocks: 25%

- U.S. Mid Cap Stocks: 25%

- US. Small Cap Stocks 15%

- Further breakdown:

Likewise, Investment Account Manager 3 Individual allows you to identify allocation targets for diversifying common stock investments by both sector and by size. If you’re uncertain on how to set these targets, you might simply use the provided benchmark for the current mix of the S&P 500. On the stock sector and stock size analysis tabs, Select the ‘guidelines’ link to use the allocation percentages of the coinciding exchange traded fund for the S&P 500.

Step 2: Updating portfolio activity

Once you have defined your target allocations by asset type, industry/sector and company size, you can rely on the many record keeping features provided by IAM3 Individual to update your portfolio activity. These include: updating portfolio activity for purchase, sale and investment income activity either by automatically downloading from your broker or manually updating in the transaction activity ledger.

- updating portfolio for recent market pricing data.

- updating portfolio for allocation characteristics by importing the asset composition data for your exchange traded funds and mutual funds using the QuoteMedia data feed or manually updating this data directly in the current asset library.

Step 3: Reviewing reports and rebalancing

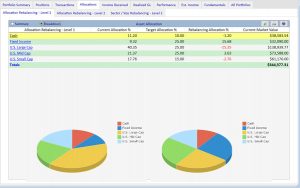

After these tasks are completed, use IAM’s home page | allocations summary tab to identify your current portfolio allocation and measure this against your portfolio targets.

For example, you might first want to review the level 1 allocation rebalancing tab to review the cash, fixed income, and stock allocations in your portfolio. This view offers you a helpful review of your current holdings and current allocations and necessary rebalancing to meet targeted goals.

Further detail is provided by the level 2 allocation rebalancing tabs, if you have updated your funds for the additional composition details by manually entering into the IAM current asset library. The level 2 allocation tabs include the portfolio compositions of any funds held in your portfolio. This means each fund’s proportional impact (amount invested in cash, bonds and stocks, etc.) will be included along with any individual holdings of each asset type held outside of your funds, providing a total allocation analysis of your portfolio.

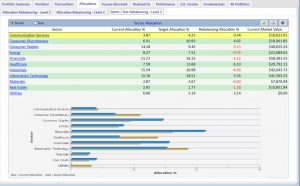

Repeat this process, reviewing both the level 2 allocation ‘by Sector’ and ‘by Size’ summary tabs to identify any rebalancing needs.

Repeat this process, reviewing both the level 2 allocation ‘by Sector’ and ‘by Size’ summary tabs to identify any rebalancing needs.

The allocations shown reflect the sector and size compositions of any funds held in your portfolio. This means each fund’s proportional impact (amount invested in financial, healthcare, small, medium, etc.) will be included along with any individual stock holdings of each sector and size held outside of your funds, providing a total allocation analysis of your portfolio.

Now that you have reviewed your allocations, you’ll be able to rebalance your portfolio as necessary to mesh with targeted goals. Prior to doing so, be sure to rely on other features provided by IAM3 Individual so the rebalancing decision is consistent with tax planning goals.

- review existing holdings, lot by lot, by printing the Security Basis Report, segregated by holding period, to list short term versus long term.

- review year-to-date sales activity to identify realized gains/losses by printing the Sold Securities Report.

Since many investors have multiple investment accounts (taxable, non taxable, spousal, etc.), Investment Account Manager 3 Individual allows users to combine on reports single/multiple/all investment portfolios to see the ‘total view’ of holdings, allocations, performance, and more. Be sure, when considering rebalancing decisions, you are combining all your portfolios for a true aggregate picture of your investment holdings.

Investment Account Manager 3 Individual includes many tools that enable investors to identify portfolio rebalancing needs in order to maintain the proper risk/reward balance. Further, portfolio rebalancing helps to reduce chances for disproportionate losses if over concentrated in one asset class and is a cornerstone of good portfolio management. And as you rebalance you effectively buy low and sell high! Portfolio rebalancing can grow/preserve wealth.