The 7Twelve® Portfolio – An Introduction

Craig L. Israelsen, Ph.D.

www.7TwelvePortfolio.com

This article introduces a multi-asset portfolio design that brings a higher standard to the notion of “diversified”. This design is referred to as the 7Twelve portfolio.

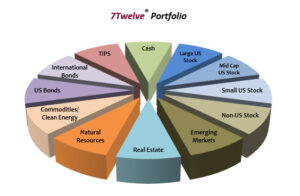

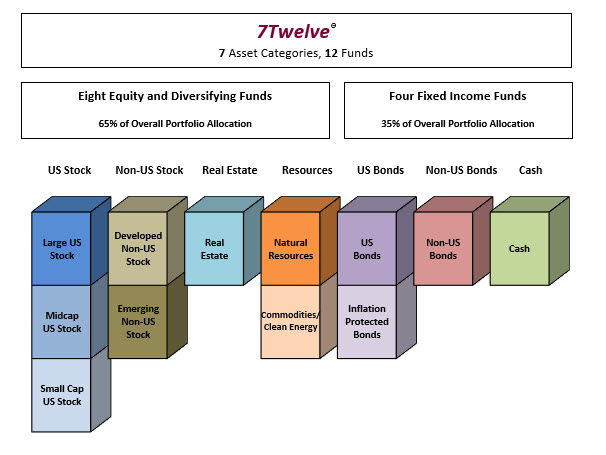

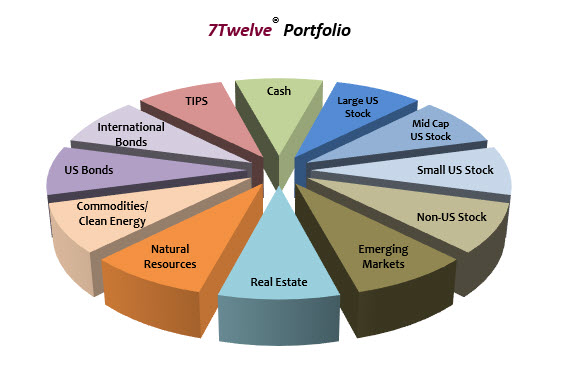

The name “7Twelve” refers to “7” asset categories with “Twelve” underlying mutual funds and/or exchange traded funds (ETFs). The seven asset categories include: US stock, non-US stock, real estate, resources, US bonds, non-US bonds, and cash. The 7Twelve model is shown below in Figure 1.

The 12 mutual funds utilized in the 7Twelve design can be index funds or actively managed funds. You can build the 7Twelve model in an IRA account, 401(k) account, regular investment account…you name it. All 12 funds are equally weighted in the “core” 7Twelve model (each with an allocation of 8.33%). The equal-weighting is maintained by periodic rebalancing. There are also three “Age Based” versions of the 7Twelve model that progressively reduce the risk of the portfolio.

You can build the 7Twelve portfolio using mutual funds and/or ETFs from a wide variety of mutual fund companies.

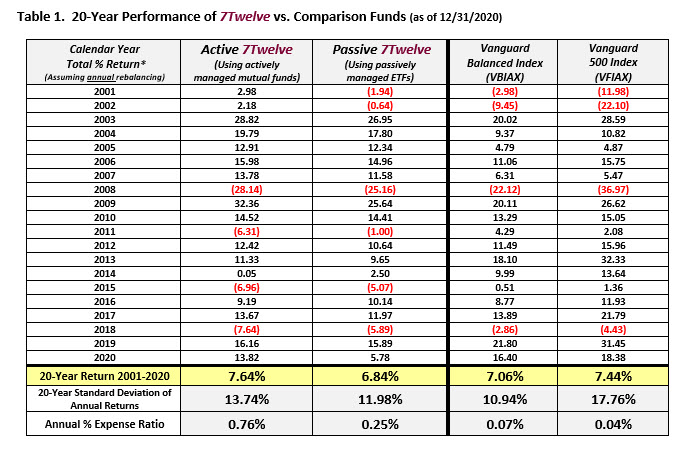

The performance of the 7Twelve model (an Active version using actively managed funds and a Passive version using ETFs) over the past 20 years is shown in Table 1. Two Vanguard mutual funds are also included as comparisons: Vanguard Balanced Index and Vanguard 500 Index.

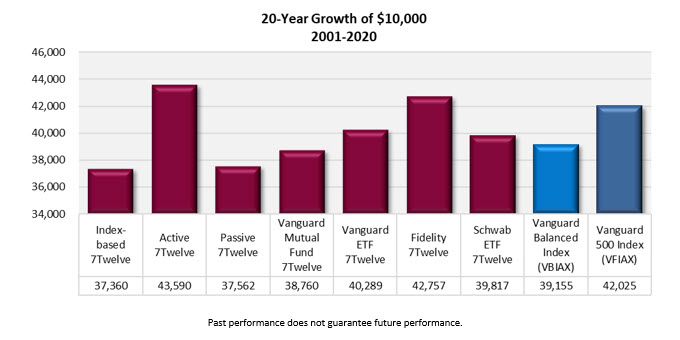

There are several 7Twelve models, all built with 12 funds covering the same 7 broad asset classes. As shown below, there is an Active 7Twelve model, a Passive model, two Vanguard models, a Fidelity model, and a Schwab model (in addition to several others). The results are consistently good. To review 7Twelve research reports that provide guidance in building one of the 7Twelve models shown in the graph below click on this link: http://www.7twelveportfolio.com/Downloads/Web7TwelveReport.pdf

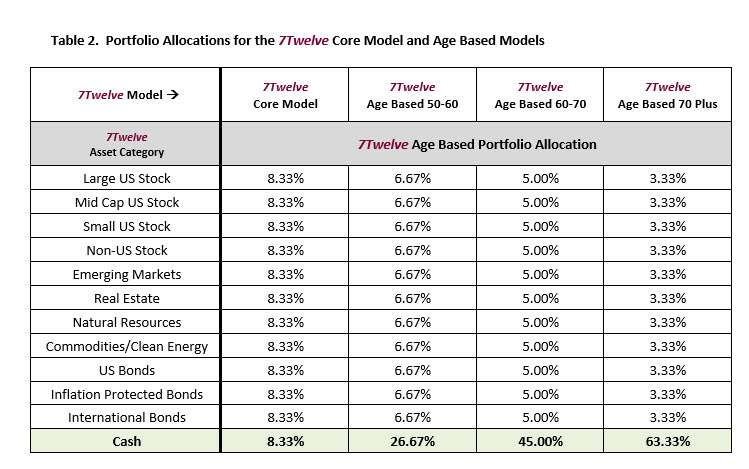

The core 7Twelve model equally weights all 12 funds (mutual funds and/or ETFs) at 8.33% each as shown below. For those wanting to build one of the 7Twelve Age Based models the suggested allocations for each of the 12 funds are shown below in Table 2.

Rebalancing the 7Twelve Portfolio

Rebalancing is a vitally important element of the 7Twelve design. Very simply, rebalancing is the process of systematically bringing each of the 12 funds in your specific 7Twelve model (Active, Passive, Vanguard, etc.) back to their allotted allocation (8.33% in the core 7Twelve model) or the specified allocation if you’ve built an Age Based 7Twelve portfolio (see Table 2). For example, some money is taken out of the funds that performed better in the prior year and deposited into the funds that under-performed in the prior year—in order to “re-balance” the account values in all the funds. That’s all that rebalancing is—a straight-forward, non-emotional portfolio management system.

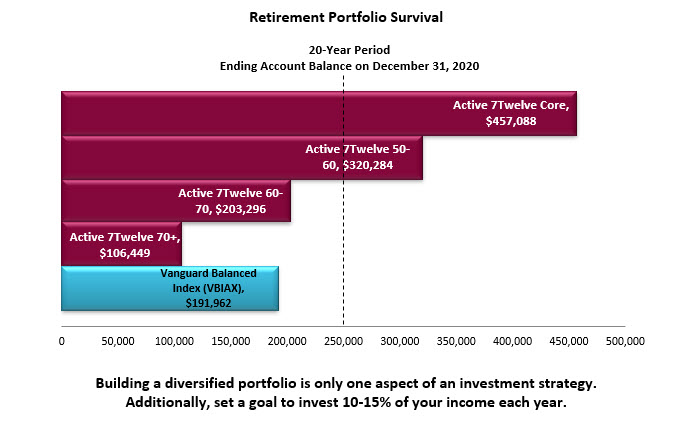

7Twelve as a Retirement Portfolio

The diversified 7Twelve portfolio performs well as an investment portfolio during the retirement years. The graph below illustrates the ending account balances on December 31, 2020 of a retirement account with a starting balance of $250,000 on January 1, 2001. The first year annual withdrawal was 5% of the balance (or $12,500). The annual cash withdrawal was increased 3% each year over the 20-year withdrawal period amounting to a total withdrawal of $335,880. The Active 7Twelve “core” model finished the 20-year period (2001-2020) with an ending balance of $457,088—substantially more than the starting balance of $250,000 (shown by the vertical dotted line). Vanguard Balanced finished with a balance of $191,962. The 7Twelve Portfolio has been a durable retirement model over the past 20 years.

– – about the author – –

Craig L. Israelsen, Ph.D. is the developer of the 7Twelve® Portfolio. He teaches in the Personal Financial Planning program at Utah Valley University. He has previously taught at Brigham Young University and the University of Missouri-Columbia. Craig writes monthly for Barron’s. He can be reached at craig@7TwelvePortfolio.com; www.7twelveportfolio.com

The name 7Twelve® is a registered trademark belonging to Craig L. Israelsen

Disclaimer: the information in this guide does not constitute an endorsement for any particular investment product.

Past performance of investment products does not guarantee future performance.