The Impact of Expense Ratios on Investment Performance

The basic idea behind investing is to grow your assets, of course. However, there are certain factors involved in the entire investment process that can take a chunk out of your expected investment returns. Investment fees are one notorious factor, so we decided that we’d look through some of the basics on expense ratios and their potential impact on investment performance…

With a vast array of mutual funds and ETFs to choose from, one of the most important things to consider in terms of long-term gains is the expense ratio. This is separate from the load, which some funds charge and when the investment is made in order to compensate brokers.

Compounding is one of the most important aspects to investing, and it’s also why investing early in retirement is important. A good way to think about expense ratios is to picture them as compounding in reverse. If you lose even 1 percent every year, that adds up significantly. Expense ratios are so important that Russel Kinnel, Morningstar’s director of mutual fund research, said that “If there’s anything in the whole world of mutual funds that you can take to the bank, it’s that expense ratios help you make a better decision. In every single time period and data point tested, low-cost funds beat high-cost funds.”

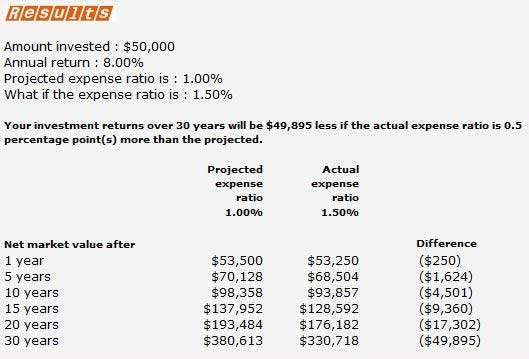

To illustrate just how impactful it is to be selective with expense ratios, I ran them through a calculator (those of you wishing to do your own calculations can do so here). Let’s say you invested $50,000 in a fund that gives a return of 8%. Disregarding any other sales loads, fees, taxes, etc, this chart illustrates precisely what your investment will look like at various points in time.

As you can see, the numbers are quite significant. A difference of half a percentage point, over time, could reduce your ending value equal to your entire original investment amount (or even more if this chart went beyond 30 years)! This just further sends home the message that, in the long run, the expense ratio of your funds is one of the most important things to consider.