The Purpose of Diversification: A Review of the Past 49 Years

Diversification is for folks who don’t know the future—which is all of us. Think of it this way, if you knew the future perfectly would you ever diversify your portfolio? Of course not. You would simply pick the single ticker that was destined to produce the highest return. End of story.

So, for the rest of us who don’t own a crystal ball…we diversify. Why? Precisely because we do not know the future. In this article, I’ll examine a variety of asset allocation “recipes” that range from non-diversified to very diversified and how they performed over the past 49 years (from January 1, 1970 to December 31, 2018) both in accumulation mode (pre-retirement) and distribution mode (during retirement). The “purpose” of diversification will become clear.

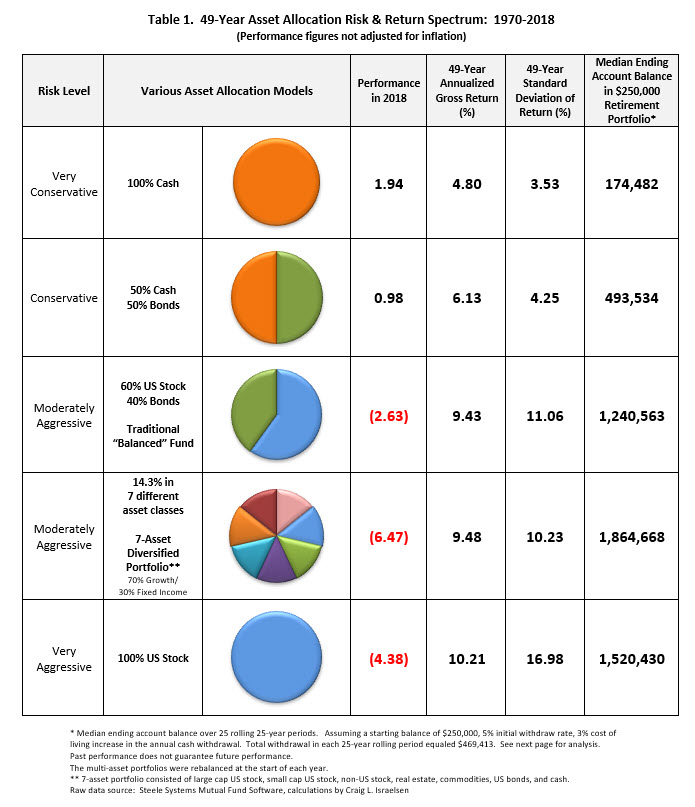

The first recipe is 100% cash (see Table 1). Having all of one’s investment dollars in a CD or savings account would represent a portfolio of 100% cash. As cash is only one asset class it does not represent a diversified asset allocation model (which implies at least two asset classes). However, as many investors often hide out in cash when they are afraid of the equities markets or worried about bonds, it’s worth examining the performance of cash over the past 49 years.

As can be seen, cash produced a return of 1.94% in calendar year 2018—the best return of the group in Table 1. The 49-year average annualized return of a 100% cash investment was 4.80% (accumulation mode performance) with a standard deviation of annual returns of 3.53%. It’s important to recognize that Table 1 is showing nominal returns that have not been adjusted for the impact of inflation (as measured by the Consumer Price Index).

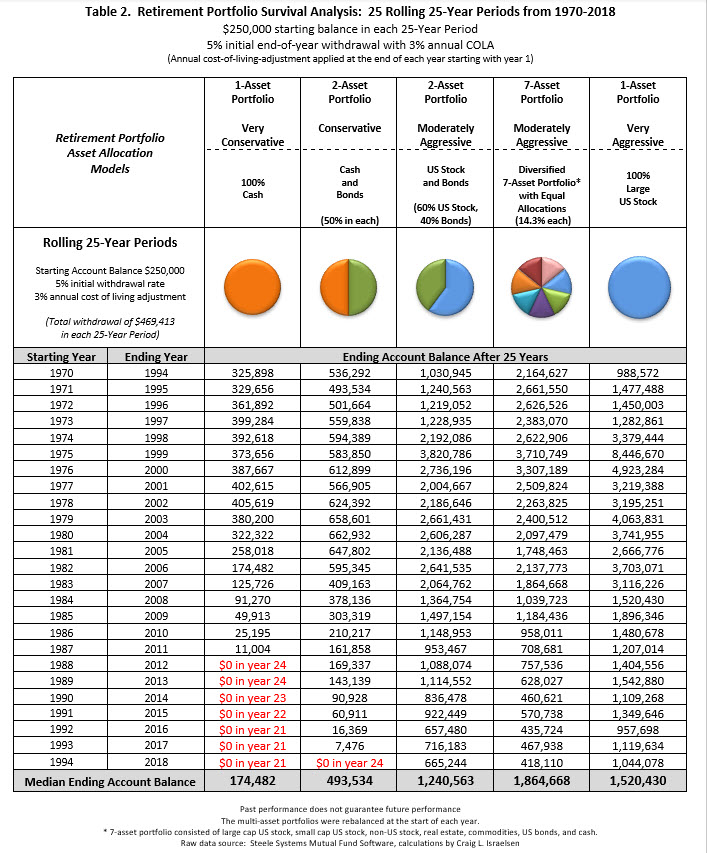

The last column in Table 1 shows the median ending account balance of a retirement portfolio. For an all-cash portfolio, the median ending account balance was $174,482 (distribution mode performance). The median ending account balance was calculated over 25 rolling 25-year periods between 1970 and 2018, where the starting balance was assumed to be $250,000 and a 5% initial withdraw rate followed by a 3% cost of living increase in the subsequent annual cash withdrawals over the next 24 years. The total withdrawal in each 25-year rolling period equaled $469,413. (See Table 2 for the results of each 25-year period).

We now move down the asset allocation food chain to a 50% cash/50% bond portfolio. This 50/50 portfolio represents actual asset allocation (that is, we are using a “recipe” that calls for more than one asset class)–albeit a very conservative model. The return of a 50% cash/50% bond portfolio in 2018 was 0.98%. The 49-year annualized return of a 50/50 portfolio was 6.13% and the median ending account balance after 25 years for the retirement portfolio was $493,534.

The next asset allocation model is a 60% large cap US stock, 40% US bond portfolio that is typically referred to as a “balanced fund”. The 60/40 portfolio lost 2.63% in 2018, whereas the 49-year annualized performance was an impressive 9.43%. The 49-year standard deviation of annual returns was 11.06%. When any type of equity ingredient is added to a fixed income portfolio the standard deviation will increase—often substantially. The 60/40 portfolio was rebalanced annually, as was the 50% cash/50% bond portfolio. The median ending account balance in a retirement portfolio that was sustaining annual withdrawals was $1.24 million.

This outcome is quite remarkable in light of the fact that the retirement portfolio began each 25-year period with a starting balance of $250,000.

Next, we examine a multi-asset portfolio that included seven different asset classes in equal portions (14.29% each) that was rebalanced annually. The asset classes included large US stock, small cap US stock, non-US developed stock, real estate, commodities, US bonds, and cash. The indexes utilized to represent these asset classes are shown at the end of the article.

The 7-asset portfolio lost nearly 6.5% in 2018—only its seventh annual loss over the past 49 years. More indicative is its 49-year average annualized nominal return of 9.48% with a standard deviation of annual returns of 10.23%–slightly better performance with less volatility than the standard 60/40 asset allocation model. The median ending balance over 25 rolling 25- year withdrawal periods was $1.86 million—over $620,000 more than the standard 60/40 model.

Finally, we examine a 100% stock model. As with the 100% cash model, this does not represent an asset allocation model (or recipe) because it only includes one asset class. But, as large cap US stock is a very prominent asset class, it is reviewed here. Large cap US stock (S&P 500 Index) lost 4.38% in 2018. However, the 49-year average annualized return was an impressive 10.21% with a standard deviation of 16.98%. The median ending retirement account balance was just over $1.5 million—roughly $344,000 below the 7-asset portfolio.

Multi-Asset is the Answer

What are the advantages of building a diversified multi-asset portfolio? Compared to a 60/40 portfolio, a 7-asset equally weighted portfolio produced 5 bps higher return over this 49-year period with nearly a 7.5% decrease in volatility. Even more importantly, the 7-asset model outperformed the 60/40 model as a retirement portfolio.

Compared to a 100% large cap US stock investment, a 7-asset portfolio had a 49-year average annualized real return that was lower by 73 bps, but as compensation had a standard deviation of return that was lower by 40%. Moreover, the 7-asset recipe produced better results during the retirement “distribution phase”.

Retirement is a Time to Stay Diversified

The analysis of retirement portfolio survival in this article used an initial withdrawal rate of 5%.

This particular rate was used for illustrative purposes and is not a suggested or recommended initial withdrawal rate for any particular retiree. An appropriate withdrawal rate is determined individually after considering a number of factors, including the amount of money in your retirement account, your age, needed income each year, anticipated number of years withdrawals may take place, anticipated annual rate of return of portfolio, anticipated general inflation rate in the overall economy, COLA being imposed, etc.).

Portfolio diversification should be a lifelong strategy—both before retirement as well as during retirement. Warning: diversification is not exciting. That’s by design. Broad diversification tends to smooth out returns which is crucially important when you start withdrawing money from a portfolio—such as in retirement. Why is it so crucial? Because the sequence-of-returns matters a great deal when money is being withdrawn from a portfolio. The scenario a retiree wants to avoid is one in which their portfolio suffers several annual losses just as they start pulling money out at the start of retirement. This would be a potentially disastrous sequence-of-returns risk which could materially reduce the longevity of their retirement portfolio. Broad diversification does not eliminate sequence-of-returns risk, but it does significantly reduce it. And, for that reason, diversification should be a central tenet in a retiree’s investment philosophy.

So, what is the purpose of diversification? Broad, multi-asset class diversification allows us to produce an equity-like return while substantially reducing the volatility of returns in the portfolio.

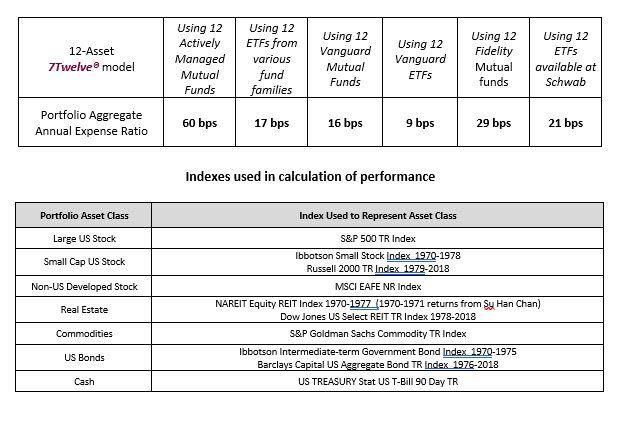

Diversified Asset Allocation is Not Expensive

Building a multi-asset portfolio need not be expensive. To illustrate this I have shown the aggregate expense ratio of a 12-asset class model known as the 7Twelve® Portfolio (disclosure: I am the designer of the 7Twelve® Portfolio). If using actively managed mutual funds from various fund families, the multi-asset portfolio can be built for 60 bps. If using ETFs, it can be built for 17 bps. If using only Vanguard ETFs, the 12-asset class 7Twelve portfolio aggregate cost can be as low as 9 bps.

Craig L. Israelsen, Ph.D. Published in AAII Journal September 2019

https://www.aaii.com/journal/article/10672-clarifying-the-purpose-of-diversification

Craig L. Israelsen, Ph.D., is a contributing editor to the AAII Journal. He teaches as an executive-in-residence in the Personal Financial Planning Program at Utah Valley University in Orem, Utah. He is also the developer of the 7Twelve Portfolio (www.7twelveportfolio.com) and the author of three books, including “7Twelve: A Diversified Investment Portfolio With a Plan” (John Wiley & Sons, 2010). Find out more about Israelsen at www.aaii.com/authors/craig-israelsen.

Note: Investment Account Manager 3 includes the 7Twelve Moderate Portfolio Index that can be used for benchmark portfolio performance comparisons.