Three Essential Points for All Investors

Craig l. israelsen, ph.d.

Point #1

Contribute at least 10% to your retirement accounts each year.

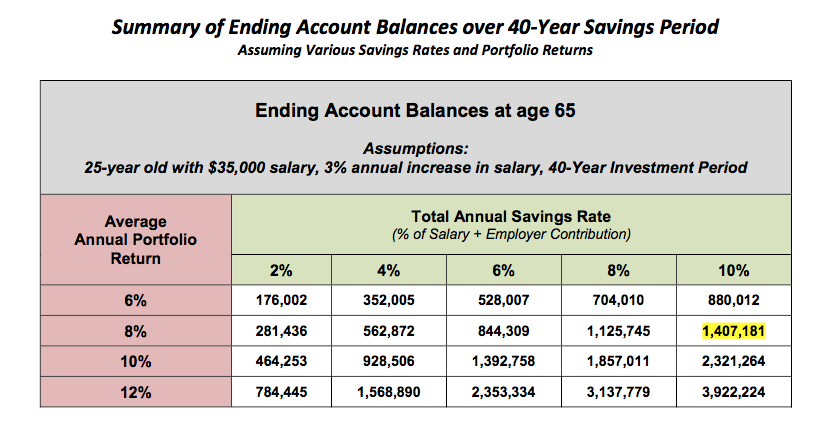

The table below shows the various retirement account balances for a 65-year old person IF they start saving at age 25.

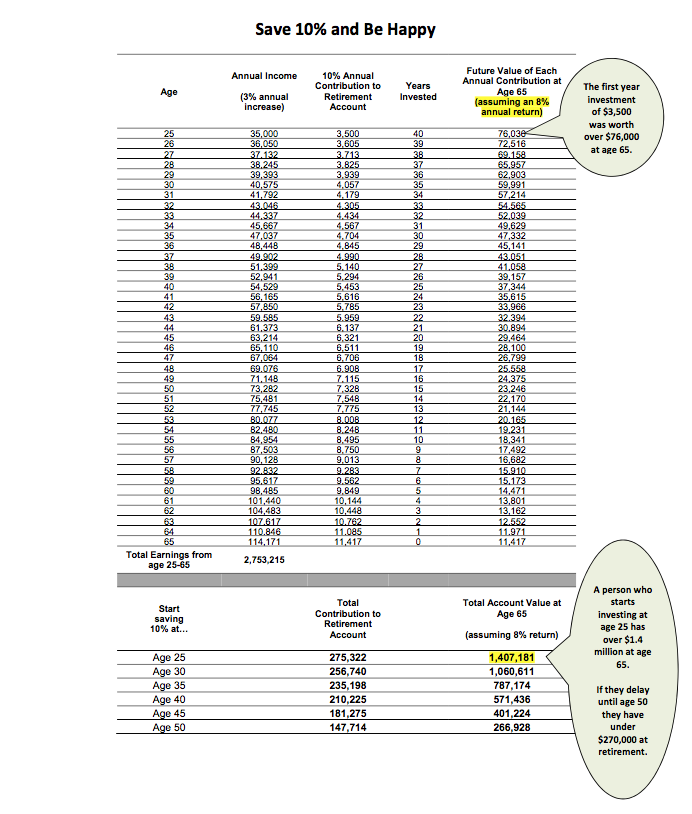

We can’t guarantee the performance of our investment portfolio, but with sacrifice many investors can contribute 10% of their income each year into their retirement accounts. Control what is controllable. Our savings rate (or contribution rate) is more controllable than our portfolio’s performance.

Check out the tables above and below. If a 25-year old saves 10% of her salary each year, at age 65 she has about $1.4 million saved (assuming an 8% annualized return). Conversely, if she only saves 4% of her salary she will have to earn nearly 12% per year to have a comparably sized retirement account at age 65. An annualized return of 8% is reasonable—expecting an average annual return of 12% isn’t reasonable (see the graph in Point #2).

Starting our retirement savings early is also critical. We all know that. Notice what happens if she doesn’t start until age 40—ending balance at age 65 of less than $600,000.

Point #2

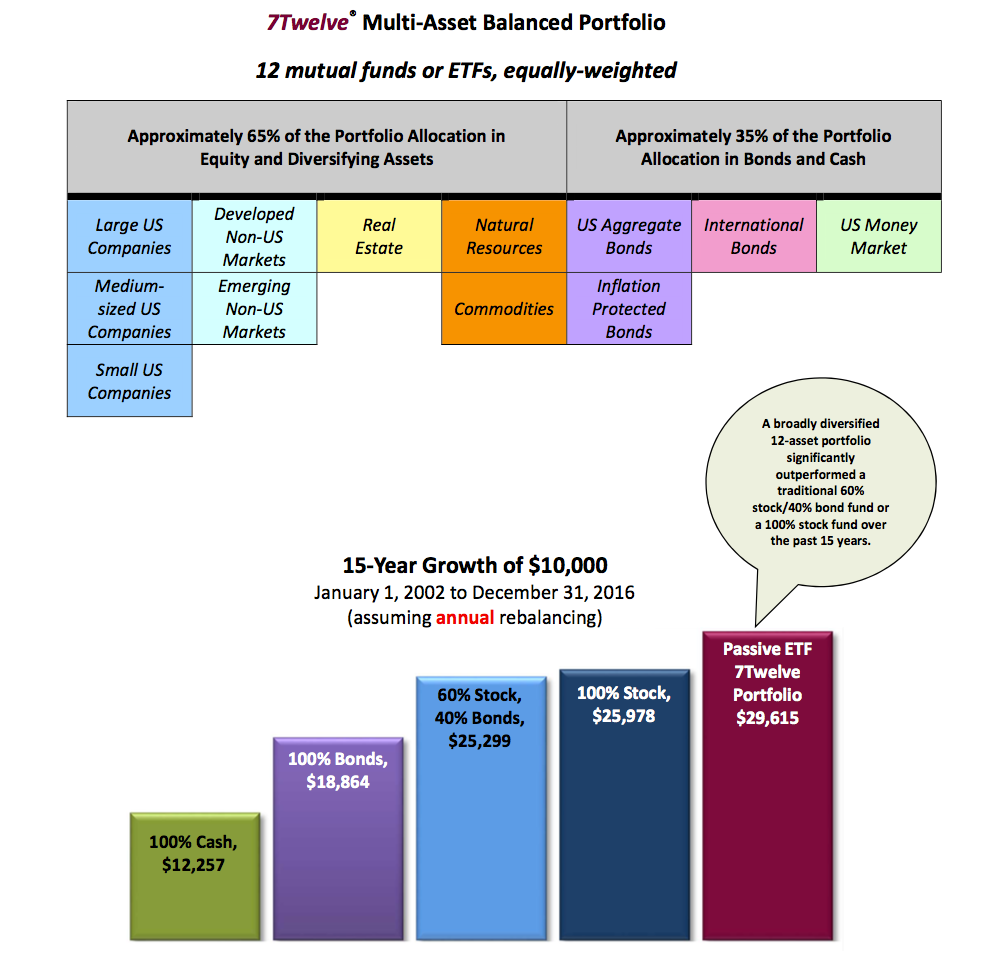

Implement a broadly diversified investment portfolio that includes stocks and bonds – and a variety of other asset classes.

Point #3

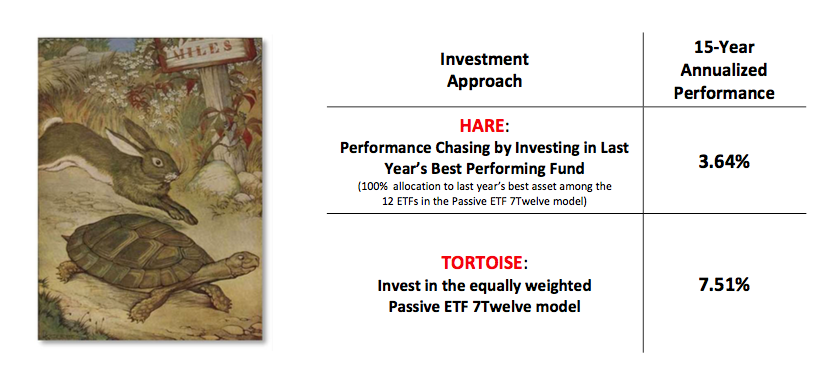

Focus on longer-term performance; Don’t “chase” performance

7Twelve Philosophy

Building a diversified portfolio is only part of the solution. Set a goal to invest 10-15% of your income each year. The portfolio’s job is to provide a modest, steady return. Our job as investors is to properly fund our portfolio each year. Most investors don’t save enough because they incorrectly expect the portfolio to do the heavy lifting. Annually saving/investing 10-15% of our income into a portfolio that earns a modest return of 7-8% each year will produce wonderful results over time.

Once you have assembled your diversified 7Twelve portfolio, it’s important to stay-the- course—don’t chase last year’s best performing funds or asset classes. The dismal results of chasing performance from 2002-2016 are shown below in contrast to staying committed to a diversified portfolio each year.

7Twelve® is a registered trademark belonging to Craig L. Israelsen.