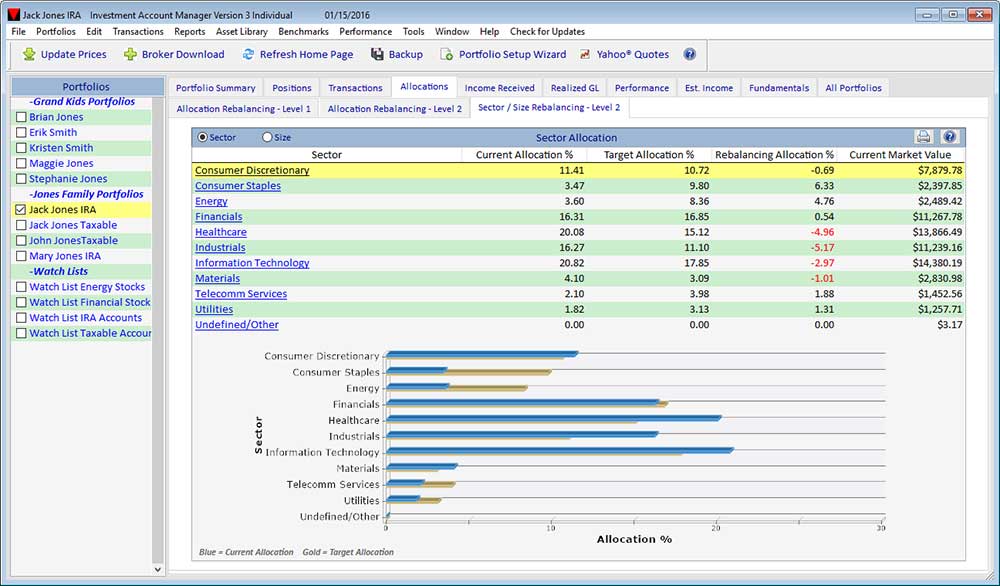

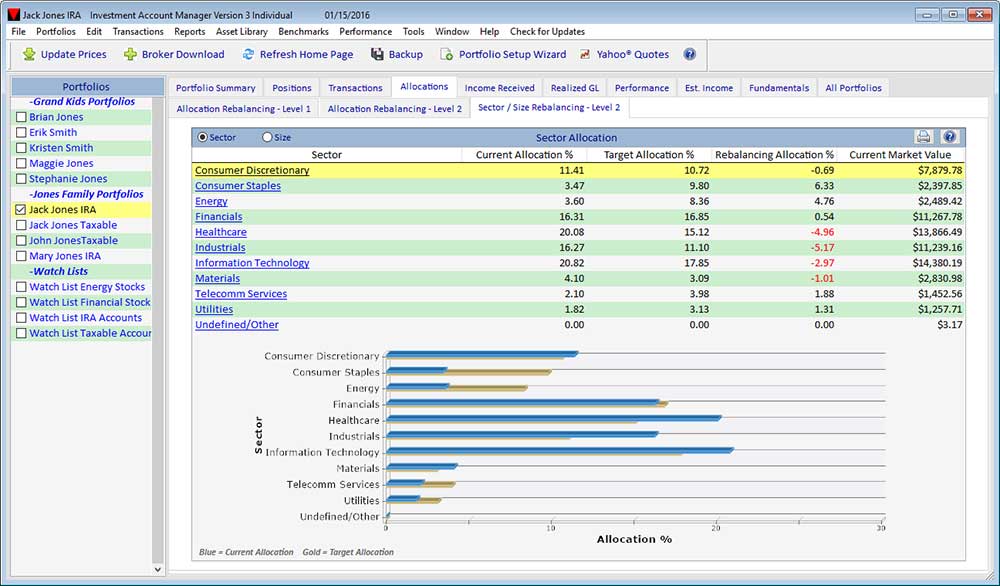

2. ANALYZE ASSET ALLOCATION AND DIVERSIFICATION

A successful approach to investing in common stocks includes the ability for investors to set target allocations for their stock holdings based on sector and size, and then identify rebalancing needs for their portfolio. Portfolio Allocation by Sector identifies the rebalancing needs for a portfolio based on user defined portfolio allocation targets as compared to current portfolio allocation weightings for common stocks based on sector.

- Stock Sector: Consumer Discretionary, Consumer Staples, Energy, Financials, Healthcare, Industrials, Information Technology, Materials, Telecommunication Services, Utilities, Undefined/other.

- Current Allocation %: percentage the current stock sector market value represents of the total portfolio market value.

- Target Allocation %: allocation percentages as defined by user.

- Rebalancing Allocation %: current allocation percentage minus target allocation. This difference indicates the rebalancing needed to remain consistent with user-defined targets.

- Current Market Value: total market value of all components in the stock sector.