3. ACCURATELY TRACK YOUR SECURITY COST BASIS INFO

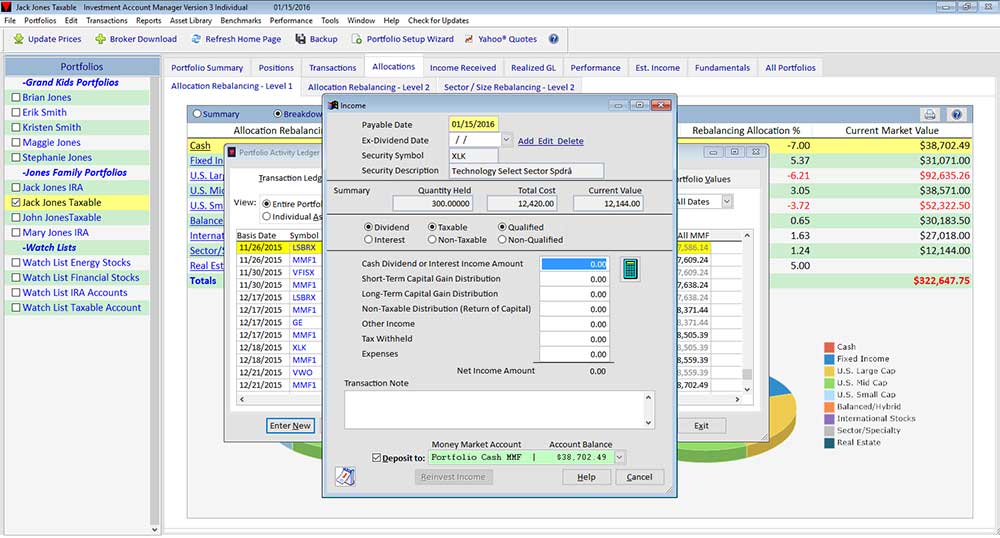

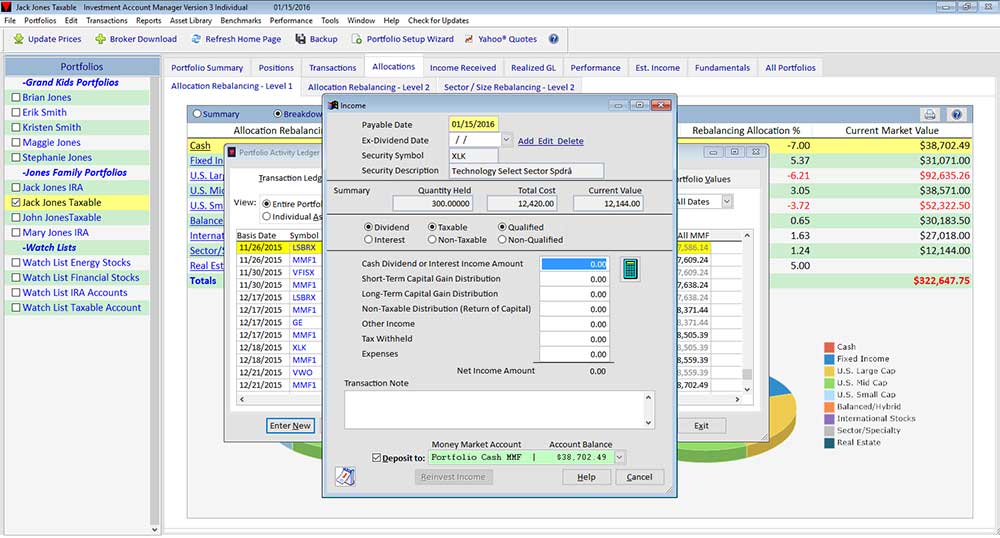

Investment Account Manager thoroughly tracks investment income received. IAM properly tracks income distributions, capital gain distributions, return of capital, tax withheld, and expenses. In the case of dividends reinvested, IAM properly creates new individual tax lots for the reinvested income. Use the Income / Reinvestment transaction screen to record details for investment income and other amounts received by the currently open portfolio.

- Ex-dividend Dates

- Income as either dividend or interest income

- Income as either taxable or non-taxable

- Income as qualified or non qualified

- Dollar amount of cash dividend or interest

- Dollar amount of short-term or long-term gain distributions

- Dollar amount of long-term gain distributions

- Dollar amount of any non-taxable distributions

- Dollar amount of any other income

- Dollar amount of any taxes withheld i.e., foreign taxes paid

- Dollar amount of any miscellaneous expenses