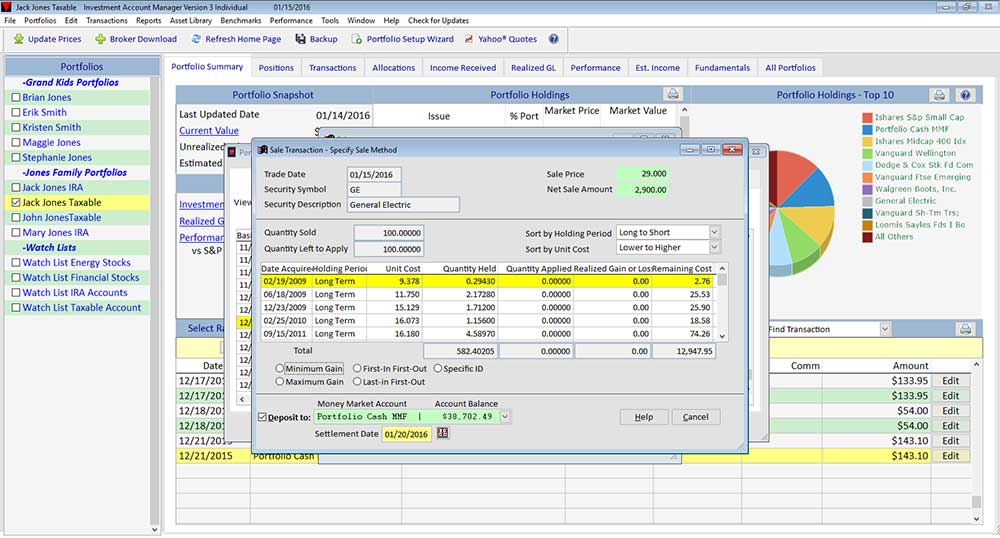

Investment Account Manager helps by providing users with the ability to use several methods for lot-by-lot assignment when making partial sales:

- Minimum Gain: use this choice to have Investment Account Manager automatically sort holdings and allocate the sold quantity to result in the minimum dollar gain realized. Security lots are sorted highest unit cost to lowest unit cost and reduced in this order until all quantity sold has been applied.

- Maximum Gain: use this choice to have Investment Account Manager automatically sort holdings and allocate the sold quantity to result in the maximum dollar gain realized. Security lots are sorted lowest unit cost to highest unit cost and reduced in this order until all quantity sold has been applied.

- First-In First-Out: when you choose to apply a sale transaction using the first-in first-out method, security lots are automatically sorted and reduced by holding period, starting with the oldest lot held, then the next oldest, and so on, until the sale is totally applied.

- Specific Identification: when you choose to apply a sale transaction using the specific identification method, you have the flexibility of applying the sale to specific asset lots held in order to maximize or minimize any associated gains or losses for tax purposes.

- Average Cost: in the sale application of mutual funds, and stocks being tracked for Canadian average cost tax rules, Investment Account Manager enables you to choose between the unit cost paid, or the average paid, to determine the capital gain or loss realized. Available options include average cost single-category and average cost double-category.