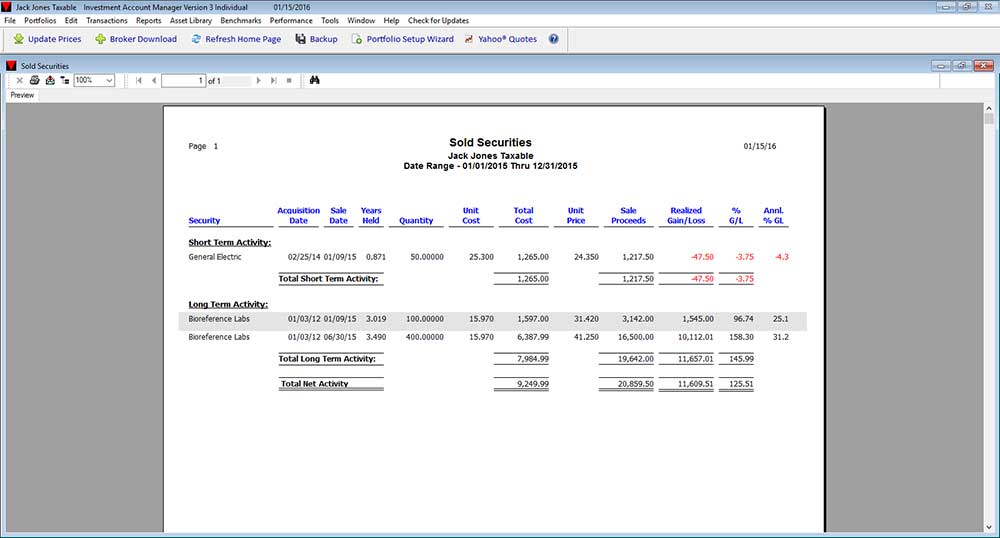

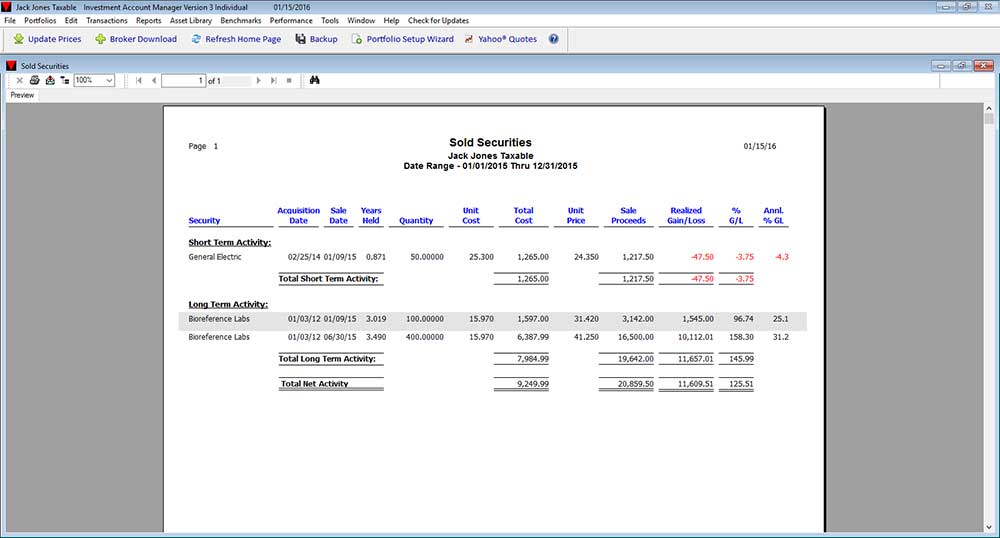

Investment Account Manager's Sold Securities Report compiles important information regarding the sales of securities for a given portfolio, providing realized capital gain and loss information. Organized to clearly summarize sales activity for the period selected, this report helps users also plan future sales armed with the knowledge of gains that have already been realized in the current tax year for the portfolio.

The Sold Securities Report compiles important information regarding the sales of securities for a given portfolio. Sales activity is separated based on Short Term Activity or Long Term Activity. The information contained on the Sold Securities Report includes:

- Security: the name or description of the asset.

- Acquisition Date: the purchase date of the security transaction lot.

- Sale Date: the sale date of the security transaction lot.

- Years Held: the number of years held for the sold security transaction lot.

- Quantity: the total quantity sold of the security transaction lot.

- Unit Cost: the unit cost paid for the security transaction lot.

- Total Cost: the total cost paid for the security transaction lot.

- Unit Price: the unit price received for the sold security transaction lot.

- Sale Proceeds: the total proceeds received for sold security transaction lot.

- Realized Gain/Loss: the total realized gain or loss for the sold security transaction lot.

- % Gain/Loss: the total percentage realized gain or loss for the sold security transaction lot.

- Annl. % Gain/Loss: the annualized percent realized gain or loss for the sold security transaction lot.