As 2021 is nearing year end, now may be an ideal time for investors to review their portfolio investments, making necessary rebalancing changes.

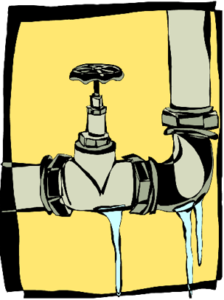

This article outlines the concept of relating leaky pipes to chronic under-performing stocks in your investment portfolio.

Leaky pipes do their damage over time, in that a small leak may not appear to be a big problem. However, the damage caused might remain undetected for years. These slow, long-term leaks can result in much more damage than a burst pipe. Why? In the case of a burst pipe, you’ll be immediately aware of problem, and can shut off the water supply. Then limiting the damage to a more isolated area.

You’ve probably been told before to prepare for the unexpected, and that’s good advice. And being prepared for the unexpected includes your finances as well.

In the event of a job loss, medical expense, or other form of unexpected financial damage, it’s important to have an emergency fund. Ask yourself what’s the worst thing that could happen to you financially. Then figure out what you’d need should disaster strike…

With the NFL 2021 season nearly underway, we here at Investment Account Manager thought to offer an approach for managing your investment portfolio, much like the general manager of an NFL team manages their team roster. Considering the holdings in your investment portfolio as your ‘roster’ may help you to identify the role of each holding within your portfolio.

Investing for the “long-run” is a very compelling mantra—at least for those who have a long-run ahead of them. For the investor who is currently 105 years old this article may be somewhat less useful. If you’re younger than 80 years old—I think it will apply. The question is simply this: just how long is the “long-run”? Is it 2 years? 5 years? 10 years? Or even longer?

With the calendar having just passed the midway point of 2021, now might be an ideal time to review your portfolio. And identify if any rebalancing changes may be necessary to stay consistent with your long-term goals.

With the run-up of stock market prices over the past several years, investors might find one or more of their investment holdings have appreciated considerably in value, now representing a disproportionate percentage by market value. With this in mind, it is important for investors to pay attention to these concentrated investment position(s), an important investment concept that often is over-looked for proper portfolio management.

There are many benefits associated with limited liability companies (LLCs). And the secret is out — LLCs are becoming the entity of choice for many new businesses. LLCs offer a high degree of customization and flexibility, and a new popular strategy is using LLCs to serve as the registered owner of an investment portfolio, referred to in this article as a “family investment company”.

So, I got your attention!

How would you get rich? Buy gold, Bitcoin, NFTs, a lottery ticket? Might work, but a slow and steady approach has a better chance of success. And what sort of financially rich – rich enough to not worry about money, or rich enough to sail the world? Either way, here are a few tips that will help you reach your goal.

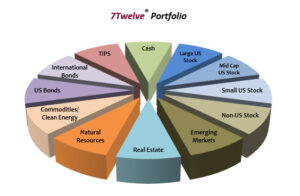

Craig L. Israelsen, Ph.D.

www.7TwelvePortfolio.com

This article introduces a multi-asset portfolio design that brings a higher standard to the notion of “diversified”. This design is referred to as the 7Twelve portfolio.