Building a Better Balanced Portfolio

Craig L. Israelsen, Ph.D.

www.7TwelvePortfolio.com

April 2017

It’s time for a better “balanced” portfolio. Way back when, there were two dominant investment categories (or asset classes), namely US stock and US bonds.

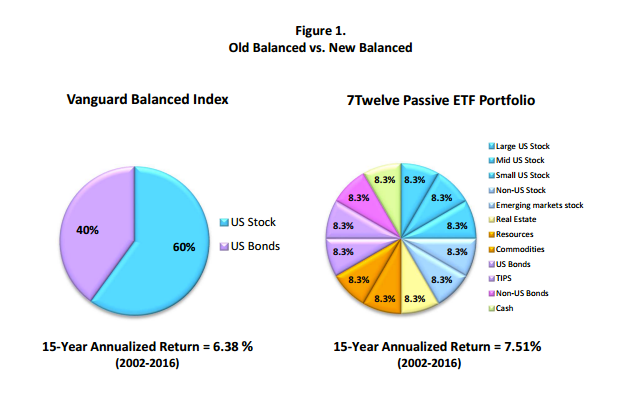

These two assets became the mainstay ingredients in balanced mutual funds, with the typical ratio being a 60% allocation to large US stocks and a 40% allocation to bonds.

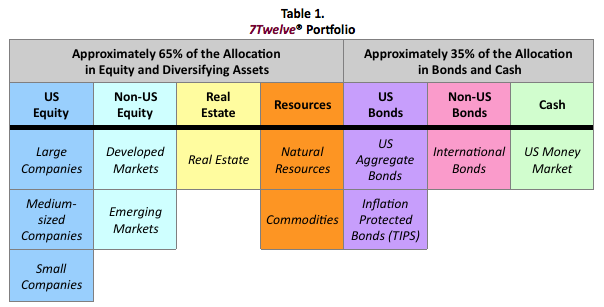

News flash, it’s not 1959 anymore. Today, there are many mainstream asset classes that should be considered when building a diversified balanced portfolio. Shown below in Table 1 are 12 sub-asset classes (or mutual funds) that belong in a 21st century balanced portfolio. The 12 funds fall within 7 core asset groups: US equity, Non-US equity, Real Estate, Resources, US Bonds, Non-US Bonds, and Cash. Within the 7 core asset groups 12 specific mutual funds are utilized.

The current reality is that most balanced funds are not broadly diversified because they are based on an out-dated model which typically employs only two assets: US large stocks and US bonds. The typical allocation is 60% S&P 500 Index and 40% Barclays Capital Aggregate Bond Index. We can do better.

This article introduces a multi-asset balanced portfolio that brings a higher standard to the notion of “balanced”. This new age balanced portfolio is known as the “7Twelve® Portfolio”. The name makes reference to “7” core asset classes with “Twelve” underlying mutual funds. The 7Twelve Portfolio is constructed to generally follow the time-tested 60/40 guideline, but uses eight funds (instead of one) to create an overall equity exposure of about 65% and 4 fixed income funds (instead of one) to create a “bond” exposure of about 35%.

All 12 funds can be low-cost index mutual funds, exchange traded funds (ETFs) or actively managed mutual funds. All 12 ingredients are equally weighted (each representing 8.33% of the 7Twelve Balanced Portfolio). The equal-weighting is maintained by periodic rebalancing (annual rebalancing is recommended).

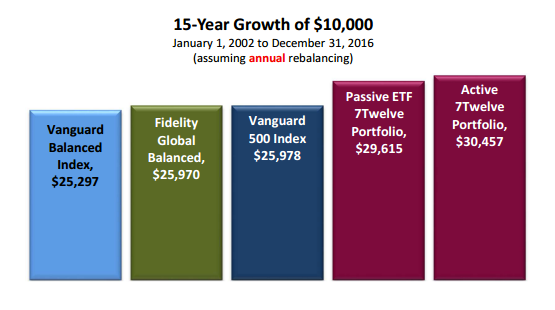

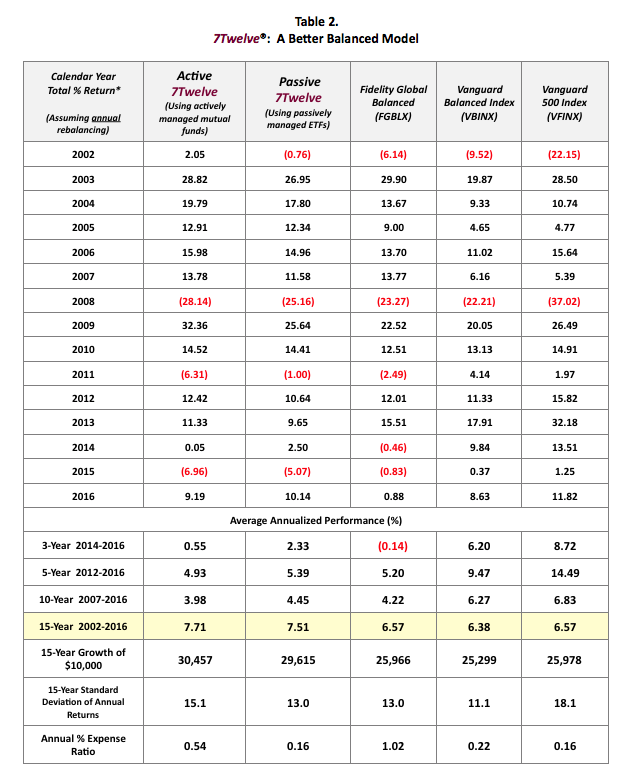

The performance of the multi-asset 7Twelve Balanced Portfolio has been better than a standard 60% stock/40% bond balanced fund and a 100% US stock fund over the past 15-year period as shown above and in Table 2. Vanguard Balanced Index is a representative fund using the standard 60/40 balanced approach. Vanguard 500 Index is a clone of the S&P 500 Index. Fidelity Global Balanced represents a somewhat more diversified balanced model compared to Vanguard Balanced Index. The “Active” 7Twelve model uses actively managed mutual funds whereas the “Passive” 7Twelve model uses exchange traded funds (ETFs).

The 7Twelve Active portfolio and the 7Twelve Passive portfolio have both generated superior performance over the past 15 years compared to Fidelity Global Balanced, Vanguard Balanced Index, or Vanguard 500 Index. However, Vanguard Balanced and Vanguard 500 Index have performed better over shorter time periods (recent 3 years and 5 years). Investing is a long-run experience—and should be measured that way.

Building a broadly diversified balanced portfolio enhances the inherent virtues of the classic 60/40 balanced model. Achieving better “balanced” performance is not the result of skill, but simply the natural byproduct of meaningful diversification and systematic rebalancing.

Portfolio diversification is a lifelong strategy—both before retirement as well as after retirement. The performance of US bonds—an asset class that retirees commonly bulk up on—will not likely be as rewarding over the next 10-15 years as has been the case over the past 20 years. As a result, a bond-heavy retirement portfolio is risky. A more prudent approach is to build a diversified retirement portfolio—such as the 7Twelve portfolio.

———————————–

Craig L. Israelsen, Ph.D. is an Executive-in-Residence in the Financial Planning Program at Utah Valley University and is the designer of the 7Twelve® Portfolio (www.7TwelvePortfolio.com). He is the author of “7Twelve: A Diversified Investment Portfolio with a Plan” by John Wiley & Sons (2010).