Millennials and Financial Literacy

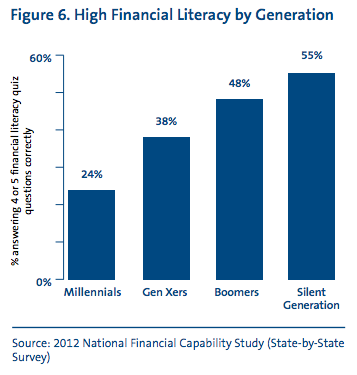

Based on the results of a quiz sent out by FINRA, Millennials are significantly less financially literate than preceding generations. When asked five questions about economics and finance, only 24% could answer four or five questions correctly, compared to 38% of Generation Xers (see graph).

Despite being offered more financial education than past generations, Millennials are still struggling to understand their personal finances. This leads to costly habits like only paying a minimum balance on a credit card, paying late and charging over their limit. Twenty-five percent of Millennials are also willing to take investment risk, which can be dangerous if they are uneducated in economics.

Despite being offered more financial education than past generations, Millennials are still struggling to understand their personal finances. This leads to costly habits like only paying a minimum balance on a credit card, paying late and charging over their limit. Twenty-five percent of Millennials are also willing to take investment risk, which can be dangerous if they are uneducated in economics.

This information can be disappointing, but Millennials are still young, and not all is lost. A great first step to combatting these statistics is to use an investment record keeping and portfolio management software similar to IAM. IAM offers an easy-to-use interface that helps every investor keep track of his/her finances, whether a novice or a seasoned pro. Plus, with numerous how-to articles and video tutorials, a novice won’t stay a novice for long.

Check out more information on the financial capability of young adults here.