1. MANAGE SINGLE OR MULTIPLE PORTFOLIOS

Investment Account Manager allows users to track an unlimited number of portfolios. Each portfolio is a unique, and transactions are segregated by account. This provides the user the ability to design portfolios by objective, reconcile quickly with specific accounts, and to track various accounts with a single tool.

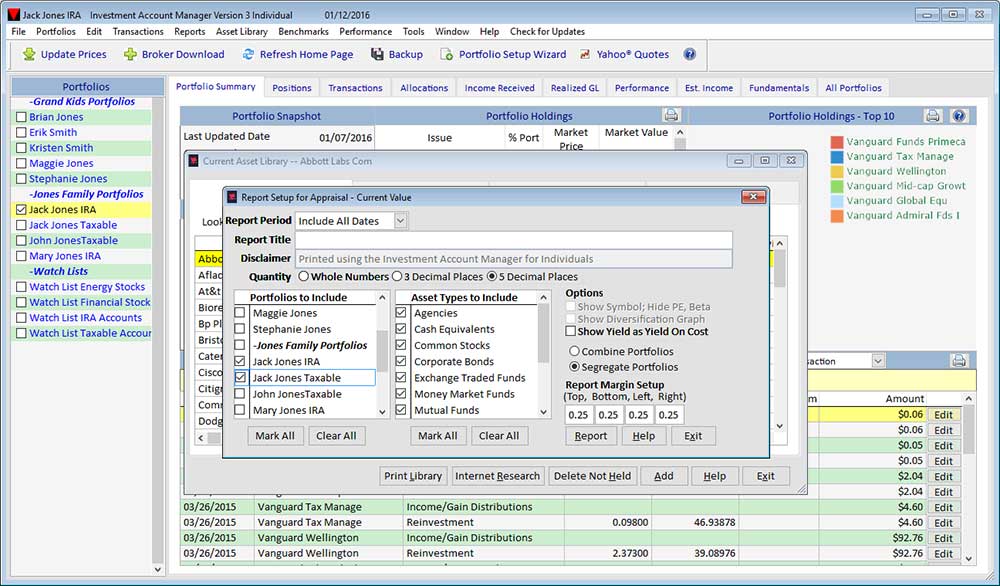

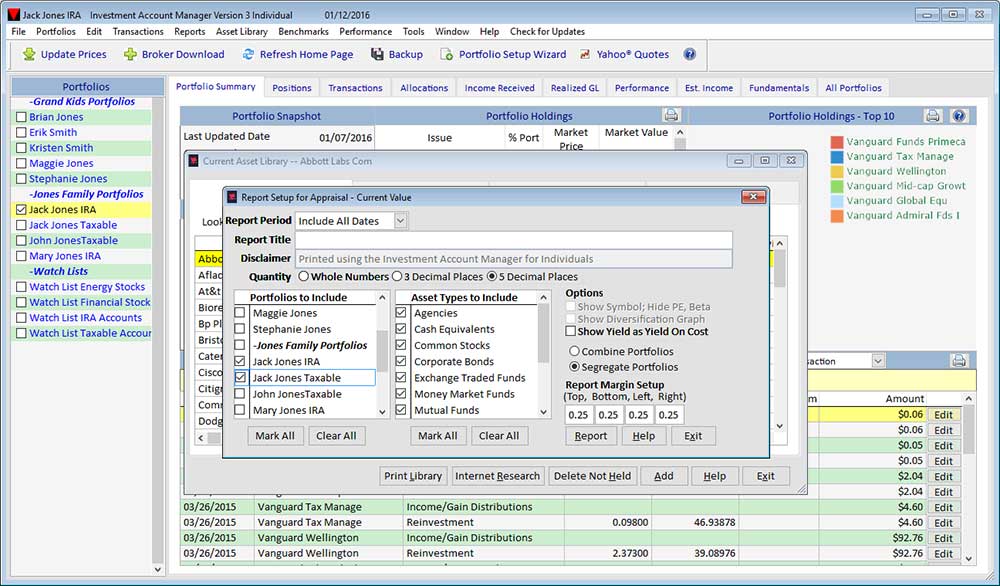

One of the ways IAM helps you to better manage multiple portfolios can be found on the comprehensive report setup screens. These screens allow you to customize any of the reports so you are able to create combinations of any of the portfolios you are managing within the software.

If for example, you have both tax deferred and currently taxable accounts within Investment Account Manager, and you were interested in better understanding the overall asset allocation of all of your holdings, you would select IAM's Asset Allocation Report and include all of your portfolios on that report using the report setup screen. Within seconds, IAM will produce a report showing your combined allocation by asset class (cash, bonds, stocks and other), by stock sector, and by stock size (large, medium or small cap).

With this information in hand, you can then better decide if you are meeting the objectives you have set forth for your individual portfolios, as well as for aggregate whole.