For many years, security valuation was viewed as an esoteric theory, mainly left to academicians. Investors did not clearly understand, nor have the computing power, to carry out the developing theory. Today, however, times have changed. MBA’s, who have had a steady diet of quantitative investment analysis, have stormed Wall Street. Sophisticated personal computers are now not only commonplace, but also essential to compete in a challenging world. The effect has been to elevate security valuation methods to an important new level in the day to day decision making process of both professional and individual investors.

(more…)

One of the basic premises of investing is that investors attempt to maximize the returns from their investments. In doing so, it is assumed that investors are risk averse, that is, given a choice between two assets of equal rate of return, an investor will select the asset with the lower level of risk. Although this relationship does not imply that all investors are risk averse, it does mean that there is a positive relationship between expected return and expected risk. So how do we define risk? (more…)

Here is a recent review of our software that was conducted by Hareesh N. Jayanthi who is an assistant financial analyst at AAII. If you’re unfamiliar with AAII, they are one of the best resources to get unbiased facts and effective knowledge about investing.

Hareesh N. Jayanthi is an assistant financial analyst at AAII and is part of the staff of Computerized Investing, the premier publication covering the use of personal computers for financial planning, investment analysis and portfolio management. As a financial columnist for AAII, Hareesh writes a variety of commentaries ranging from reviews of products to analysis of model portfolios and stock screens.

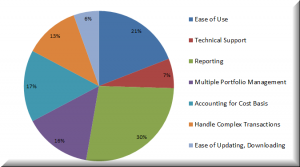

Provided here are a few comments received for each of these categories so you can see what other users are saying about their top ‘likes’ of Investment Account Manager…

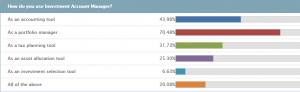

In a recent survey to users of the Investment Account Manager, we asked the following question: How do you use Investment Account Manager?

The cost of investing is a crucial component of overall portfolio performance. Informed investors must understand the impact of investment fees and expenses, since the cumulative impact of these fees and expenses can be substantial. This is especially true with an ever growing universe of investment options, and the various levels of account management services, all having their costs. So, while most investors regularly monitor investment holdings, investment costs must likewise be reviewed. (more…)

Since 1985 we have offered our customers the best portfolio management software the industry has to offer, and a large part of why our software is critically acclaimed is due to how safe and secure your information is.

Our software is based around the idea that your information is your own and no one else’s. We don’t have access to it, we can’t download it and your information isn’t cloud based. Your information is stored safely and securely on your home computer.

Current market volatility requires investors to reaffirm goals, reassess investments and rebalance portfolios with the goal of sound, long-term portfolio management. By identifying risk characteristics, return goals and time horizon, investor’s are able to balance their portfolio to properly match asset allocations (cash, bonds, stocks, other) to reach these goals.

Warren Buffet has said “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.” This pretty much sums up the Buy and Hold strategy. It can be defined as perhaps the most straightforward, passive portfolio management strategy…

As investors build their investment portfolio, it is important to maintain a proper allocation to targeted goals for investment types (cash, fixed income, stocks, etc.), depending on the investor’s tolerance for risk. Investment Account Manager includes some guidelines that may help investors with setting their investment objectives.