What’s the key to making good investment choices? It isn’t necessary to understand the inner workings of the securities markets or the mathematical economies underlying investment theory. Instead, 10 axioms of effective investing provide the critical cornerstone for guiding investment philosophy and making decisions. This will ensure that you meet the universal goal of creating financial wealth for retirement.

As evident with the recent volatility in the stock market, investing inherently involves some risk – that’s just the way life works. Our job as investors is to figure out ways in which to minimize this risk. One common method that investors use to minimize risk is dollar cost averaging (DCA). Dollar Cost Averaging offers a strategy for investors to gradually increase their stock market exposure for potential long-term upside results, while taking into account the whipsaw nature of current market conditions.

With the recent run-up of stock market levels over the past several years, many investors might find one or more of their investment holdings have appreciated considerably in value, now representing a disproportionate percentage by market value. With this in mind, it is important for investors to pay attention to these concentrated investment position(s), an important investment concept that often is over-looked for proper portfolio management.

Craig L. Israelsen, Published in the AAII Journal in November 2019 (Updated in January 2020 with full-year 2019 performance)

As found in the Merriam Webster dictionary the term “benchmark” has the following definitions:

With the start of 2020, now is an ideal time for investors to review their forward-looking investment objectives, understanding these objectives are affected by short- and long-term needs and changing requirements.

This fact sheet provided by the CFA Institute will help you work with your financial adviser to determine how to best meet your financial goals. If you are an independent investor, we think you too will find this fact sheet worthwhile for helping you to better manage your investment portfolio(s). (more…)

Saving is a key principle. People who make a habit of saving regularly, even saving small amounts, are well on their way to success. It’s important to open a bank or credit union account so it will be simple and easy for you to save regularly. Then, use your savings to plan for life events and to be ready for unplanned or emergency needs.

As the close of 2019 quickly approaches, investor’s should start thinking ahead, reviewing and taking advantage of tax saving strategies. Here are three important tips that will help investor’s manage tax consequences, while helping to better manage their investment portfolio(s).

Highlights:

> Investors have a natural bias to invest domestically.

> Exposure to international stocks can improve portfolio performance over the long term.

> How best to invest internationally is a subject of considerable debate.

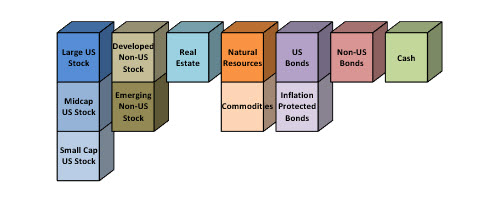

Diversification is for folks who don’t know the future—which is all of us. Think of it this way, if you knew the future perfectly would you ever diversify your portfolio? Of course not. You would simply pick the single ticker that was destined to produce the highest return. End of story.

Stock prices fluctuate for a myriad of reasons. Understanding a number of the possible causes for price fluctuations will help investors make better portfolio management decisions.