Asset Class

- Cash - includes Money Market Funds, Cash Equivalents, cash held by Mutual & Exchange Traded Funds.

- Bonds - includes Corporate, Tax-Exempt, Governments, Agencies, bonds held by Mutual & Exchange Traded Funds.

- Domestic Stocks - includes domestic common stocks, domestic common stocks held by Mutual & Exchange Traded Funds, and domestic preferred stocks.

- Foreign Stocks - includes foreign stocks, foreign stocks held by Mutual & Exchange Traded Funds, and foreign preferred stocks.

- Other - includes Investment Clubs, Options, Other Investments, other held by Mutual & Exchange Traded Funds.

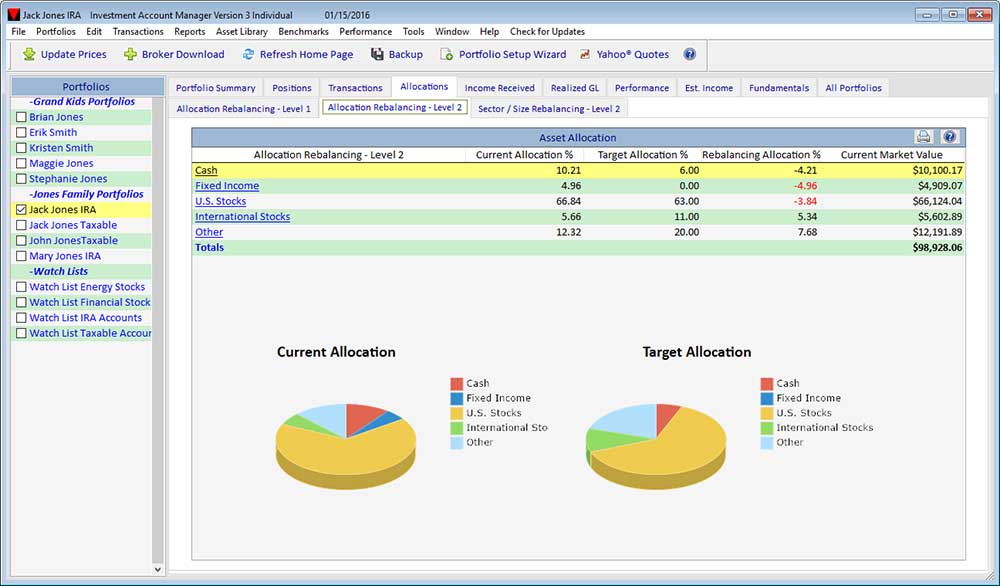

Current Allocation %: percentage the current class market value represents of the total portfolio market value.

Target Allocation %: allocation percentages as defined by user, based on investment profile.

Rebalancing Allocation %: current allocation percentage minus target allocation. This difference indicates the rebalancing needed to remain consistent with user-defined targets.

Current Market Value: total market value of all components in the asset class.