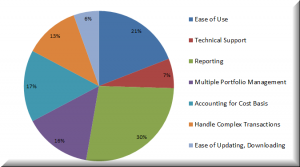

Provided here are a few comments received for each of these categories so you can see what other users are saying about their top ‘likes’ of Investment Account Manager…

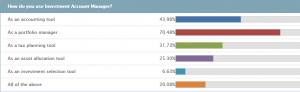

In a recent survey to users of the Investment Account Manager, we asked the following question: How do you use Investment Account Manager?

The cost of investing is a crucial component of overall portfolio performance. Informed investors must understand the impact of investment fees and expenses, since the cumulative impact of these fees and expenses can be substantial. This is especially true with an ever growing universe of investment options, and the various levels of account management services, all having their costs. So, while most investors regularly monitor investment holdings, investment costs must likewise be reviewed. (more…)

Since 1985 we have offered our customers the best portfolio management software the industry has to offer, and a large part of why our software is critically acclaimed is due to how safe and secure your information is.

Our software is based around the idea that your information is your own and no one else’s. We don’t have access to it, we can’t download it and your information isn’t cloud based. Your information is stored safely and securely on your home computer.

Current market volatility requires investors to reaffirm goals, reassess investments and rebalance portfolios with the goal of sound, long-term portfolio management. By identifying risk characteristics, return goals and time horizon, investor’s are able to balance their portfolio to properly match asset allocations (cash, bonds, stocks, other) to reach these goals.

Warren Buffet has said “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.” This pretty much sums up the Buy and Hold strategy. It can be defined as perhaps the most straightforward, passive portfolio management strategy…

As investors build their investment portfolio, it is important to maintain a proper allocation to targeted goals for investment types (cash, fixed income, stocks, etc.), depending on the investor’s tolerance for risk. Investment Account Manager includes some guidelines that may help investors with setting their investment objectives.

Financial lingo can be a little convoluted, intricate and downright torturous. Often times we think we know what something means, when in reality we have no idea. We here at Investment Account Manager want to clear the air for you and make your experience with our software an easy and enjoyable one.

Those who deal in mutual funds, much like the clients investing with them, are out to make money. There are a variety of different ways they do this, and one of them is through something called a sales load.

The basic idea behind investing is to grow your assets, of course. However, there are certain factors involved in the entire investment process that can take a chunk out of your expected investment returns. Investment fees are one notorious factor, so we decided that we’d look through some of the basics on expense ratios and their potential impact on investment performance…