Dollar Cost Averaging

As evident with the recent volatility in the stock market, investing inherently involves some risk – that’s just the way life works. Our job as investors is to figure out ways in which to minimize this risk. One common method that investors use to minimize risk is dollar cost averaging (DCA). Dollar Cost Averaging Continue reading Dollar Cost Averaging

Posted on April 1, 2020

Concentrated Investment Positions

With the recent run-up of stock market levels over the past several years, many investors might find one or more of their investment holdings have appreciated considerably in value, now representing a disproportionate percentage by market value. With this in mind, it is important for investors to pay attention to these concentrated investment position(s), an Continue reading Concentrated Investment Positions

Posted on March 1, 2020

Benchmarking: The Art of the Science

Craig L. Israelsen, Published in the AAII Journal in November 2019 (Updated in January 2020 with full-year 2019 performance) As found in the Merriam Webster dictionary the term “benchmark” has the following definitions: a mark on a permanent object indicating elevation and serving a reference in topographic surveys and tidal observations. Continue reading Benchmarking: The Art of the Science

Posted on February 1, 2020

Defining Your Investment Objectives

With the start of 2020, now is an ideal time for investors to review their forward-looking investment objectives, understanding these objectives are affected by short- and long-term needs and changing requirements. This fact sheet provided by the CFA Institute will help you work with your financial adviser to determine how to best meet your financial Continue reading Defining Your Investment Objectives

Posted on January 1, 2020

Save and Invest…

Saving is a key principle. People who make a habit of saving regularly, even saving small amounts, are well on their way to success. It’s important to open a bank or credit union account so it will be simple and easy for you to save regularly. Then, use your savings to plan for life Continue reading Save and Invest…

Posted on December 2, 2019

2019 Year-End Tax Planning Tips for Investors

As the close of 2019 quickly approaches, investor’s should start thinking ahead, reviewing and taking advantage of tax saving strategies. Here are three important tips that will help investor’s manage tax consequences, while helping to better manage their investment portfolio(s). Continue reading 2019 Year-End Tax Planning Tips for Investors

Posted on November 19, 2019

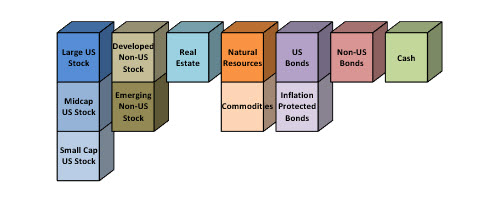

The Inherent Value of Global Diversification

Highlights: > Investors have a natural bias to invest domestically. > Exposure to international stocks can improve portfolio performance over the long term. > How best to invest internationally is a subject of considerable debate. Continue reading The Inherent Value of Global Diversification

Posted on November 1, 2019

The Purpose of Diversification: A Review of the Past 49 Years

Diversification is for folks who don’t know the future—which is all of us. Think of it this way, if you knew the future perfectly would you ever diversify your portfolio? Of course not. You would simply pick the single ticker that was destined to produce the highest return. End of story. Continue reading The Purpose of Diversification: A Review of the Past 49 Years

Posted on October 1, 2019

Stock Prices Fluctuate for a Myriad of Reasons

Stock prices fluctuate for a myriad of reasons. Understanding a number of the possible causes for price fluctuations will help investors make better portfolio management decisions. Continue reading Stock Prices Fluctuate for a Myriad of Reasons

Posted on August 15, 2019

Mid Year Rebalancing Tips

As we’re now past the halfway point of 2019, we pass along this reminder that now might be an ideal time to review your portfolio and identify if any rebalancing changes may be necessary to reach long-term goals. Here’s a multi-step guideline that you will find helpful to accomplish this important portfolio management task. Continue reading Mid Year Rebalancing Tips

Posted on July 1, 2019