As we’re nearing the end of 2020, we pass along this reminder that now might be an ideal time to review your portfolio and identify if any rebalancing changes may be necessary to reach long-term goals. Here’s a multi-step guideline that you will find helpful to accomplish this important portfolio management task.

Jonathan Clements | Editor of HumbleDollar.com

I’m probably a year or two away from regularly tapping my portfolio for income. That prospect—coupled with this year’s market turmoil—has led me to tinker with my investment mix and ponder how I’ll generate cash once I’m retired. One surprising result: I have more in stocks today than I’ve had at any time in the past three years, and I’m thinking of increasing my allocation even further.

“Nothing lasts forever but the certainty of change.” — Bruce Dickinson

The passage of the SECURE Act has resulted in major changes to the tax rules governing contributions to, and required withdrawals from, qualified retirement plans and IRA accounts.

In many cases, the Act makes existing estate planning for retirement benefits obsolete.

While most of the changes will accelerate taxes on retirement assets, there are also some taxpayer-friendly changes as well.

With summer now under way, gardening hobbyists are busily weeding, watering and tending to their plants in hope of a bountiful crop.

..[while this article was written for investment professionals, we’re confident individual investors will also find this article very informative for managing their investments]…

The year 2019 was a great run for the S&P 500 Index. Its 12-month total return of 31.49% was more 3x higher than its 50-year average annualized return of 10.60%. All good, right?

What’s the key to making good investment choices? It isn’t necessary to understand the inner workings of the securities markets or the mathematical economies underlying investment theory. Instead, 10 axioms of effective investing provide the critical cornerstone for guiding investment philosophy and making decisions. This will ensure that you meet the universal goal of creating financial wealth for retirement.

As evident with the recent volatility in the stock market, investing inherently involves some risk – that’s just the way life works. Our job as investors is to figure out ways in which to minimize this risk. One common method that investors use to minimize risk is dollar cost averaging (DCA). Dollar Cost Averaging offers a strategy for investors to gradually increase their stock market exposure for potential long-term upside results, while taking into account the whipsaw nature of current market conditions.

With the recent run-up of stock market levels over the past several years, many investors might find one or more of their investment holdings have appreciated considerably in value, now representing a disproportionate percentage by market value. With this in mind, it is important for investors to pay attention to these concentrated investment position(s), an important investment concept that often is over-looked for proper portfolio management.

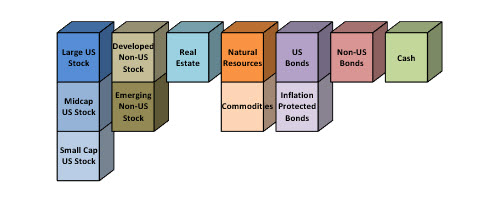

Craig L. Israelsen, Published in the AAII Journal in November 2019 (Updated in January 2020 with full-year 2019 performance)

As found in the Merriam Webster dictionary the term “benchmark” has the following definitions:

With the start of 2020, now is an ideal time for investors to review their forward-looking investment objectives, understanding these objectives are affected by short- and long-term needs and changing requirements.

This fact sheet provided by the CFA Institute will help you work with your financial adviser to determine how to best meet your financial goals. If you are an independent investor, we think you too will find this fact sheet worthwhile for helping you to better manage your investment portfolio(s). (more…)