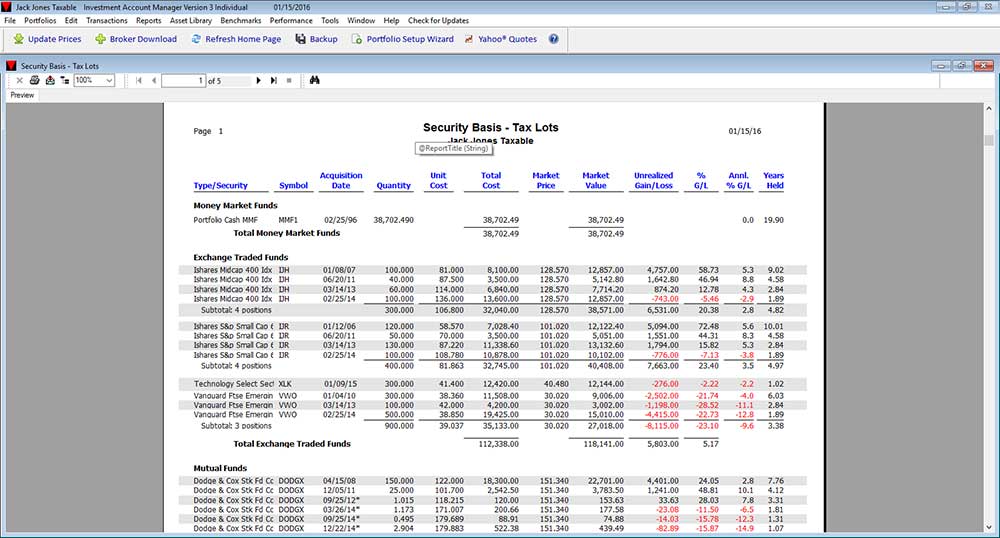

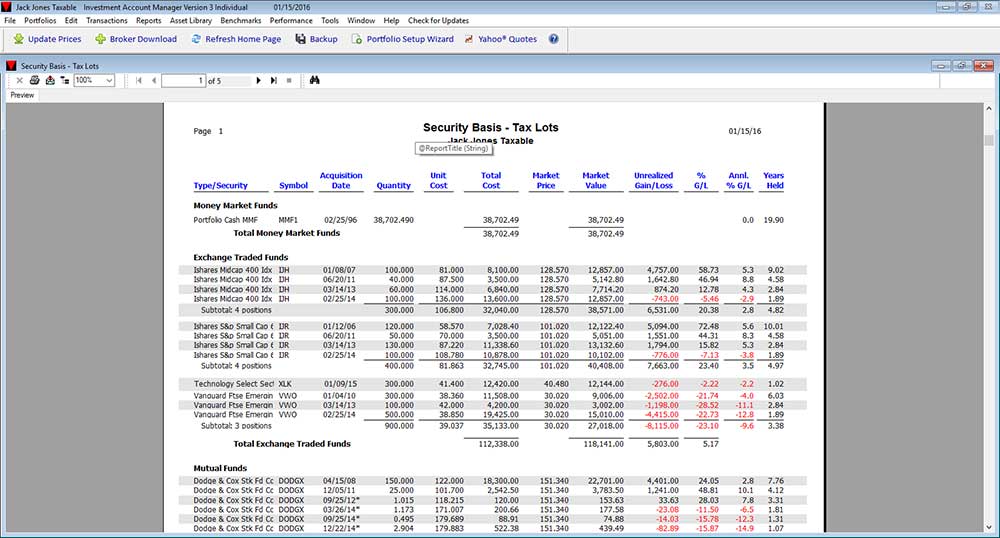

3. ACCURATELY TRACK YOUR SECURITY COST BASIS INFO

Since 2011, investors bear the responsibility to accurately report accurate cost basis data when reporting sales to the IRS, not the financial institution. Additionally, the risk of significant penalties for reporting errors will fall on consumers as part of the new legislation. Since 1985, our customers have enjoyed the benefits of accurate cost basis reporting. Additionally, knowing the lot-by-lot costs of your investments allows you to make smarter investment decisions.

Since 1985, our customers have enjoyed the benefits of accurate cost basis reporting, including the complicated impacts of:

- Lot by lot allocation and identification when selling

- Dividend reinvestment plans

- Return of capital transactions

- Stock splits

- Company reorganizations including spin-offs and mergers

- Basis adjustments due to stock option activity — calls, puts, assignments, exercises, and expirations

- Transfers of securities between portfolios

- Wash Sales

- And other important cost basis adjustments