The Role of Portfolio Management on Investment Performance Results

As an investor, it’s important to understand the relations between risk and returns. Some investments come with a quick return ‘promise’ while other investments may lead to a larger risk. Make sure you are aware of how to evaluate your risk appetite. Continue reading The Role of Portfolio Management on Investment Performance Results

Posted on April 30, 2018

5 Things to Do In Your 50s and 60s to Boost Retirement Savings

When you’re young, it’s easy to fall into the trap of thinking there’s no rush to save for retirement. But before you know it, you may find yourself in your 50s or 60s, and nowhere near your retirement savings goal. Even those who started saving early on may have concerns about saving enough for their retirement Continue reading 5 Things to Do In Your 50s and 60s to Boost Retirement Savings

Posted on February 15, 2018

Portfolio Rebalancing: December Offers a Perfect Time for This Important Portfolio Management Task

With December upon us, and 2017 nearly at end, investors might find this an ideal time to review their portfolio holdings and make necessary rebalancing changes for long term goals. This article will review the importance of rebalancing and how to accomplish this crucial portfolio management task. Continue reading Portfolio Rebalancing: December Offers a Perfect Time for This Important Portfolio Management Task

Posted on December 12, 2017

Best Practices for Portfolio Rebalancing

The primary goal of a rebalancing strategy is to minimize risk relative to a target asset allocation, rather than to maximize returns. Continue reading Best Practices for Portfolio Rebalancing

Posted on October 11, 2017

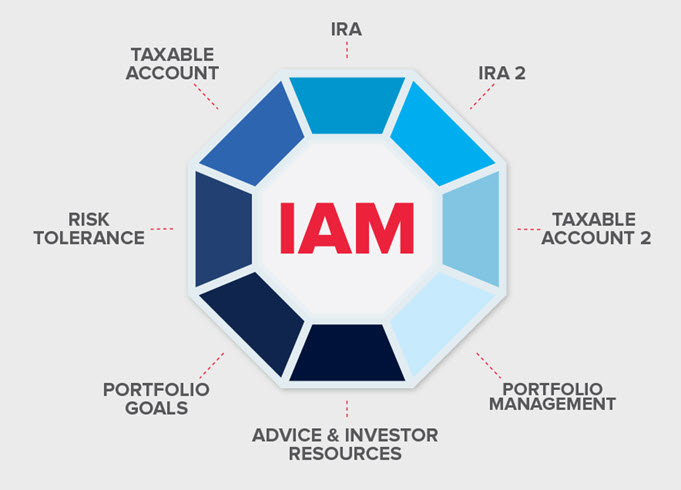

Come Down from the Cloud with IAM

The world of online portfolio management has seen a lot of turbulence lately. From the Equifax breach to Google Finance’s recent announcement that it will no longer house your portfolio, many investors have been left scrambling to find better ways to protect and manage their financial information. Continue reading Come Down from the Cloud with IAM

Posted on September 27, 2017

T+2 Is Almost Here

The SEC will adopt an amendment to shorten the standard settlement cycle for most broker-dealer securities transactions by one business day. What was once known as T+3 will become T+2 on Monday, September 5. Continue reading T+2 Is Almost Here

Posted on August 31, 2017

A New Periodic Table of Performance

// Craig L. Israelsen, Ph.D. www.7TwelvePortfolio.com Summer 2017 The well-known Callan chart (Periodic Table of Investment Returns by Callan Associates) visually depicts the year-to-year performance of various asset classes and has been an incredibly value contribution to the literature of finance. Continue reading A New Periodic Table of Performance

Posted on August 25, 2017

Unified Investment Account Management

Unified investment account management is extraordinarily important in order to achieve investment success. Continue reading Unified Investment Account Management

Posted on July 28, 2017

What is Investment Account Manager?

Posted on July 27, 2017

Three Essential Points for All Investors

Posted on June 30, 2017